April 9, 2025 – Soup has long been a culinary staple, known for its versatility, comforting qualities, and ability to cater to diverse tastes and dietary preferences. Whether it is a hearty meal or a light starter, soup holds cultural significance and continues to evolve with global palates.

Innova’s 360 research into soup trends highlights regional performance, brands, and product launches. It also includes brands response to consumer demands and innovation opportunities yet to come across the industry.

Soup Market Size and Influences

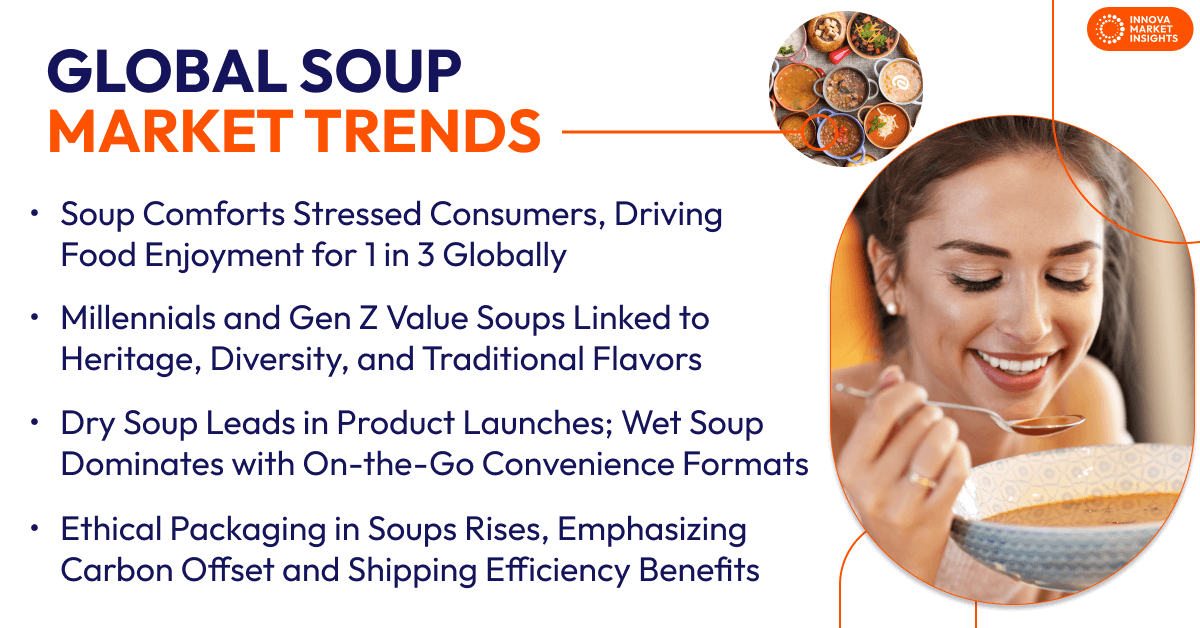

In a stressed world soup becomes a source of comfort, driving food enjoyment for 1 in 3 consumers globally. The important drivers of enjoyment and pleasure in food are fresh ingredients, richness of flavors, and homemade. As soups link with these drivers and cater to care under the weather, e-commerce companies like Spoonful of Comfort and Grandma’s Chicken Soup built their business around it.

Globally consumers, especially Millennials and Gen Z, value national pride, diversity, and tradition/heritage in food. Soups appeal to them by providing a cultural glimpse into the history, climate, and lifestyle of various regions. Soup trends research reveals that consumers also seek familiar, healthy, and traditional flavors within the soup category. Soup’s appeal, ingredient adaptability, and easy to prepare makes it a celebrating celebrated dish across regions. The adaptability of soup makes it suitable for many dining occasions. During periods of inflation, many choose to dine at home to save money, making soup an ideal option. Its economical nature drives the category sales in value, slightly outpacing volume growth through 2027. This global appeal helps the category to maintain its stability and growth over time.

Regional Performance and Top Companies

North America leads the global soup market, followed by West Europe and Asia over the past year. Soup trends research shows that the Middle East is forecast to grow in volume, outpacing the leading regions, through 2027. The UK and the Netherlands have highest per capita soup consumption, as the recipes are from their heritage and traditions. The top markets are the US, Japan, Russia, UK, and France. While the fastest growing and largest market is India, driven by ready-to-eat and frozen segments.

Globally, Campbell and Unilever lead in wet soups, while Unilever and Nestlé in dry soups. These three players have been prominent in total product launches over the past five years. Private labels overpower top wet and dry soups brands in subcategory launches over the past year.

Product Launch Trends

Dry soup outpaces wet soup in launches across the globe over the past two years. This reflects manufacturers leveraging dry mixes for their localized customization and relevance. Despite the rise of dry soup launches, wet subcategory leads the market by offering on-the-go formats and convenience options that cater to solo dining and family gatherings.

West Europe tied Asia in product launches in the past year. Soup trends research display that Africa sees increase in launches during the same period, likely due to GB food’s expansion in Nigeria and Ghana, as well as its joint venture partnership with Helios.

Claims and Flavors Trends

Soup trends research shows vegetarian and vegan claims are prominent choice claims in launches, while halal and plant-based are fastest growing claims over the past year. Globally, half of soup launches carry health claims, with no additives or preservatives claims lead in them during the same period. Other notable claims include natural, low/no/reduced fat, and source of fiber and protein. Functional health claims such as immune health, digestive/gut health, and weight management are emerging in the category. Ethical claims, particularly packaging, are increasing in product launches over the past year. Brands are articulating the benefits of ethical packaging in terms of carbon offset and shipping load, raising awareness among consumers.

Globally, 29% of consumers are willing to experiment with new soup flavors. The top flavors they seek include salty/savory, fresh, spicy-hot/chili, and spicy-pungent. Vegetable flavor leads the global soup category followed by poultry, meat and fish. While sauces and condiments, ethnic, and dairy flavors are growing. Chicken and red tomato flavors gain consumers’ attention in both wet and dry launches, with onion and carrot flavor showing growth over the past year.

What’s Next in Global Soup Trends?

The soups category is changing responding to modern consumers’ desire for convenient, comforting, and health-conscious options. With its ability to combine infinite flavor profiles, soup offers opportunities for innovation and cultural connection. From nostalgic recipes reminiscent of homemade meals to unique mashups of iconic comfort foods, the category is rich in potential.

Brands can continue to integrate health-forward features, such as nutrient-dense ingredients and claims around gut health or immunity-boosting properties in their launches. Offering refrigerated soups in diverse flavors and single-serve or family-size options could appeal to busy consumers looking for fresh, high-quality meals. Localized recipes, like rasam or tamarind-based soups, can connect to cultural roots while attracting adventurous consumers curious about global cuisines. Brands can educate consumers on using soups in creative ways, whether as meal bases, starters, or side dishes, through omnichannel campaigns.

Consumers are increasingly attracted to global cuisine flavors, brands that cater to this demand incorporating health/functional claims in affordable rate are likely to grow in the global soup market.

This article is based on Innova’s Soup – Global report. This report is available to purchase or with an Innova Reports subscription. Reach out to find out more