January 15, 2025 – Fish and seafood are valued for their versatility, nutritional benefits, and alignment with health-conscious and sustainable lifestyles. Innova’s 360 research highlights how fish and seafood industry trends are evolving globally. It also highlights top brands, regions, and what may develop in the future.

Global Seafood Industry Market Size and Trends

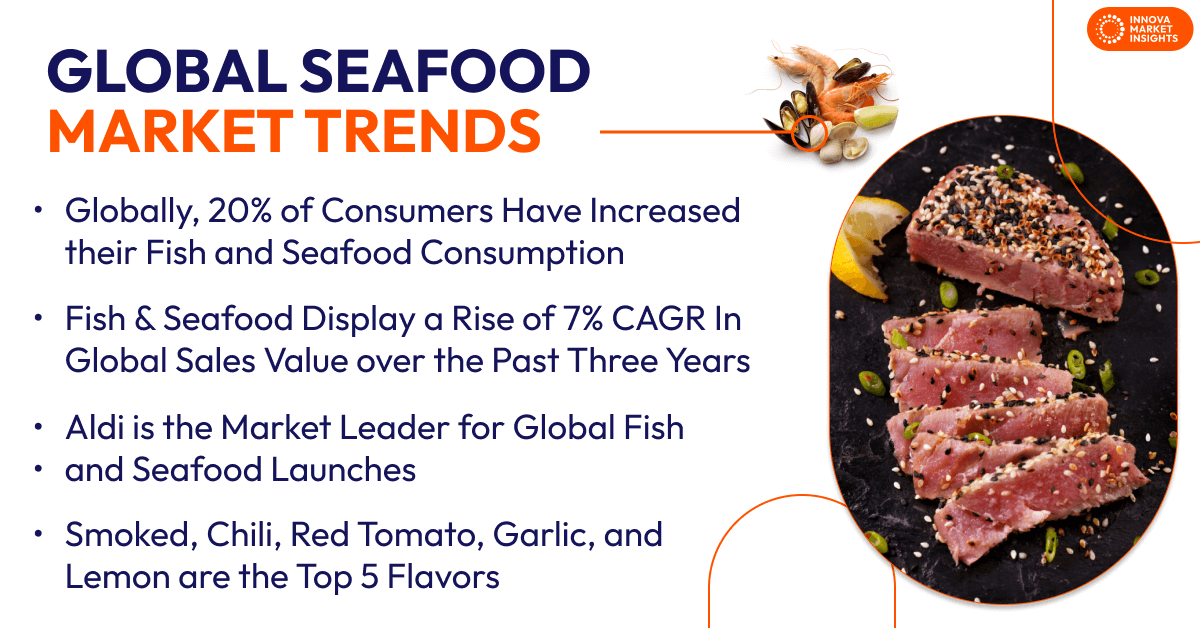

The fish and seafood industry has displayed a rise of 7% CAGR in global sales value over the past three years. 56% of consumers globally emphasize that honesty and transparency of products are important in their diets. In alignment with this, fish and seafood with clean label claims such as no additives/preservatives, natural, organic, and GMO-free appeal to consumers seeking products that prioritize transparency and quality.

Fish and seafood has shown a fluctuating trend in launches as a percentage of the meat, fish, and eggs category over the past three years. However, the growth in value and volume for the fish and seafood subcategory averages at 7% and 4%, respectively, in the past five years.

Globally, 20% of consumers have increased their fish and seafood consumption due to the wider variety and novelty of options available. Products featuring diverse bases like tuna, salmon, shrimp, and sardines, prepared minimally through marination, pre-frying, or breading, drive new product development in the past year. Canned fish varieties, offered in mediums such as water, oil, tomato sauce, and soy sauce, cater to evolving tastes and cooking preferences globally. This innovation highlights the global seafood industry’s adaptability to meet consumer demand for quality, variety, and convenience.

Leading Regions in the Seafood Market

Globally, the fish and seafood subcategory are the second leading in the meat, fish and eggs category over the past year. Europe is the top region for fish and seafood subcategory launches in the seafood industry, followed by Asia Pacific, the Middle East/Africa, and Latin America.

In Europe, 34% of consumers appreciate diverse foods that showcase various cultures.

Addressing this preference, fish and seafood inspired by cuisines from diverse regions feature a variety of ethnic flavors, such as Japanese teriyaki, Indian tikka masala, Arabian harissa, Mexican ensalada de atún, and Chinese sweet and sour. The seafood industry is incorporating these diverse flavor profiles, driving innovation in new product development.

This varied selection reflects the increasing consumer interest in foods that embrace different cultures, highlighting their willingness to explore diverse cuisines across Europe. This reflects Innova’s annual top trend of 2024, ‘Local Goes Global,’ where consumers are progressively looking for products influenced by a variety of regional cuisines.

Top Global Seafood Industry Brands and Companies

Globally, Aldi is the market leader for fish and seafood launches and is driven by its brands The Fishmonger, Gourmet Finest Cuisine, and Golden Seafood in the past year.

Aldi demonstrates its commitment to responsible fish and seafood sourcing by partnering with organizations like the SFP, adhering to MSC and ASC certifications, and supporting Fishery Improvement Projects to ensure marine resource sustainability.

The company emphasizes transparency by providing detailed labels with common and scientific fish names, fishing methods, harvesting areas, and production processes to build consumer trust. This approach aligns with Innova’s annual top food trend of 2024, ‘Nurturing Nature,’ which highlights that brands are prioritizing responsible seafood sourcing and transparency for informed choices.

Lidl, Auchan, Viciunai Group, Bolton Alimentari, Carrefour, and Spar are other notable companies in the fish and seafood market. These top 7 companies account for 14% of fish and seafood launches in the past year.

Claims and Positionings Trends

Omega-3, source of protein, no additives or preservatives, indulgent and premium, and gluten free are the top 5 positionings in global fish and seafood subcategory launches.

Globally, 40% of consumers value selecting foods that reflect their cultural heritage and traditions. This is reflected in the 46% CAGR in the fish and seafood industry with traditional claims in the past four years.

Apart from the top 5 positionings, other positionings growing across Europe are lactose free, organic, and traditional claims. In Asia Pacific, consumers prefer no trans fats, high/source of fiber, and traditional claims. Low/no/reduced fat, traditional, and lactose free claims are growing in the Middle East/Africa, whereas in North America, traditional, GMO free, and DHA options are preferred.

Fish and Seafood Flavors Trends

43% of consumers globally cite that taste/flavor is the most significant factor that impacts their purchasing of fish and seafood. Smoked, chili, red tomato, garlic, and lemon are the top 5 flavors in the fish and seafood launches.

Products blend spices with fruits, such as black pepper and lemon, curry and orange, and habanero chili and mango, appealing to diverse culinary preferences. This aligns with Innova’s top flavor trend of 2024, ‘Savor the Contrast,’ which emphasizes adventurous flavor combinations, exploring the crossover of spice and fruit notes, and creating innovative taste experiences globally.

What Is Next in Global Seafood Industry?

Almost 2 in 3 consumers globally choose fish and seafood because it is healthy. In line with this, launches with health claims globally display significant growth in the seafood industry. Omega-3-rich products support heart and eye health, promote muscle growth with their high protein content, and offer low-fat, low-sodium options for health-conscious consumers. These benefits make them ideal for preventing heart disease, eye issues, and other health issues, which might boost product development.

Simultaneously, indulgence plays a significant role for 21% of consumers globally, highlighting interest in gourmet offerings like caviars, high-quality shellfish, and premium fish choices such as tuna tartare and swordfish steak. These options deliver a refined culinary experience that aligns with growing demand for indulgent yet health-conscious products.

As consumers continue to seek both health and indulgence, fish and seafood innovations are likely to focus on offering premium options with nutritional value.

This article is based on Innova’s Overview in Fish & Seafood – Global report. This report is available to purchase or with an Innova Reports subscription. Reach out to find out more