August 27, 2024 – European consumers are increasingly seeking out indulgent food and beverage experiences, despite economic uncertainties. While cost-of-living concerns are a major factor, consumers still value treating themselves and find enjoyment in premium food and drink. Here we will analyze the latest consumer food trends in indulgence, highlighting consumer attitudes, purchase drivers, and various product trends in the European food and beverage market.

European Consumer Insights in Indulgent Food Trends

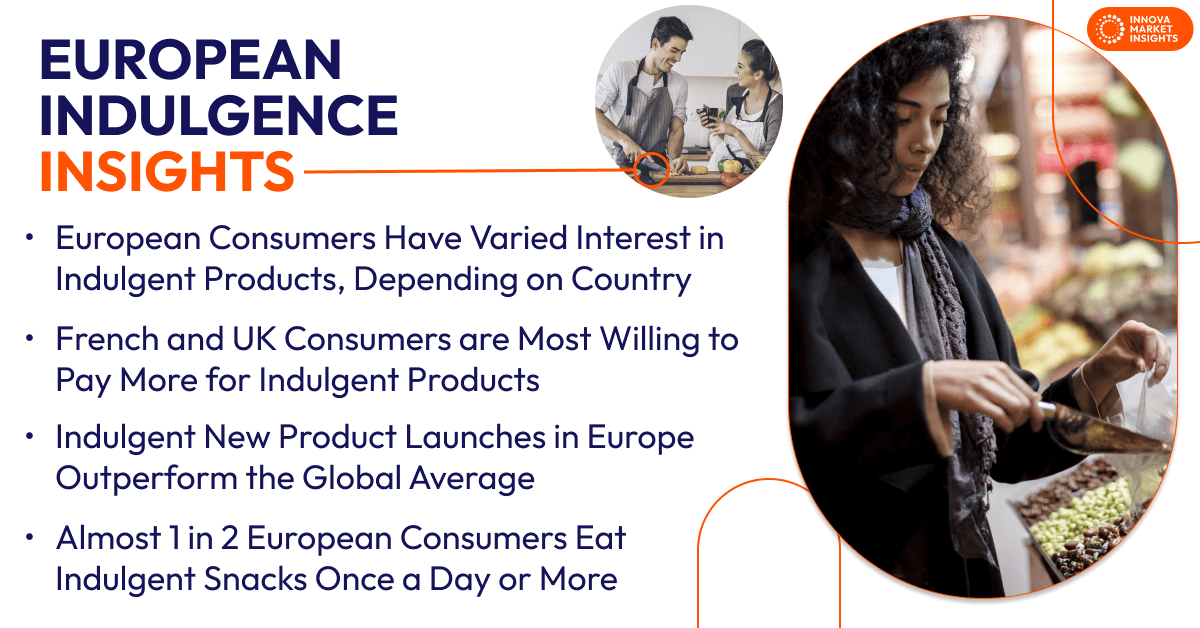

European consumers have varying attitudes towards indulgence and health. Consumers in France and Spain value indulgent foods as sources of pleasure more so than healthy foods, while in Germany and the UK the opposite is true.

In everyday treats, European consumers value indulgent attributes. 42% of German and 41% of French consumers say that indulgent is an important attribute that makes a good everyday consumable treat, compared with figures of 33% and 31% for the UK and Spain, respectively.

However, European consumer food trends research shows they are less likely than the global average to plan on increasing their premium food and drink consumption for the next twelve months; globally, 1 in 5 consumers plan on increasing their consumption, while for consumers from European countries it ranges from 11% to 15%.

Indulgence Drivers for European Consumers

According to European consumer food trends research, around 1 in 4 consumers from Germany and France say that indulgence has become a more important factor to them over the past year. Comparatively, 12% of Spanish consumers say the same, and only 6% of UK consumers feel this way. When asked whether indulgent products are worth paying more for, French and UK consumers were top respondents.

The top reason European consumers give for choosing indulgent foods is to boost mood. Around 1 in 4 also name sensory experience/enjoyment as a motivator for treating themselves. Newness and novelty is another key reason to treat.

The top categories Europeans choose when consuming indulgent foods are chocolate, cakes, pastries and sweet goods, desserts and ice cream, and sweet biscuits and cookies.

Indulgent Food Trend Innovation

Indulgent new product launches in Europe are outperforming the global average. Over the past five years, global indulgent new product launches have increased by 7% CAGR, compared to 10% in Europe. West Europe represents 35% of global activity in this category, while East Europe makes up 2%.

Hot drinks is the leading indulgent category for launches in Europe, followed by bakery, confectionery, alcoholic beverages, and desserts and ice cream. Alcoholic beverages is the fastest growing category, followed by dairy and hot drinks.

Indulgent Flavor Trends

European consumer food trends research indicates shows when looking for indulgent tastes, they most often choose sweet products. This is followed by sweet and salty/savory, nutty, fruit/superfruit, and salty/savory. When choosing indulgent flavors, ‘brown’ flavors is the top choice, followed by coffee, creamy and rich, berries and summer fruits, and tropical fruits.

Adding Indulgence Through Texture

Smooth textures are the most common textural claim seen on indulgent products in Europe. This is followed by velvet, creamy, tender, and crispy.

A case study in textural indulgence is Gü Indulgent Foods. The UK company is a key innovator in the indulgent pot desserts arena across the globe. Many products are layered, creating interesting textures and mouthfeel. The range includes alcohol-inspired flavors (Espresso Martini Cheesecake, Passionfruit Martini Cheesecake), and in 2019, the company added plant-based options, including cheesecakes and mousses.

A Focus on Indulgent Snacking

Consumer food trends research shows that Europeans are frequent snackers, with enjoyment and pleasure being the top drivers of consumption. While health is also important, indulgence remains key.

Almost 1 in 2 European consumers say that they eat indulgent snacks once a day or more. Enjoyment and pleasure are the top drivers for snacking, followed by comfort and reward. European consumers also agree that snacking can be both tasty and healthy.

When asked what attributes make a snack indulgent, consumers chose sweet flavors most often, followed by rich, natural, and savory flavors, as well as crispy/crunchy and creamy textures.

What’s Next in European Consumer Indulgence Trends?

European consumers find value in using food and beverages to boost their mood. Brands can attempt to further tap into this through conveying mood boosting qualities on their indulgent products. Language used on packaging is fundamental in the indulgent food area; consumers want to feel uplifted in this regard.

Bitesize portions are also a way for consumers to indulge while managing their intake. Smaller portions, such as enrobed fruit pieces, are seeing attention from innovators as a way of offering mouthfuls of decadent indulgence without overload.

Finally, plant-based new product development is growing within the indulgence space. Brands will likely continue to find opportunities in the indulgent plant-based market, with consumers seeking products that fit their dietary needs.

This article is based on our report, “Now & Next in Pure Indulgence in Europe.” If you are interested in reading this report, feel free to request a demo.

You can do this by either booking a demo or using our Contact Form.