February 17, 2025 – Lifestyles are evolving as consumers prioritize long-term well-being, focusing on nutrition, fitness, and proactive health choices to support healthy aging. It spans generations from Generation Z to Boomers and encompasses a holistic approach to health. Innova’s 360 research highlights how consumer attitudes and perceptions about health and their actions toward a healthy lifestyle can shape the global food and beverage industry.

Consumer Insights and Preferences

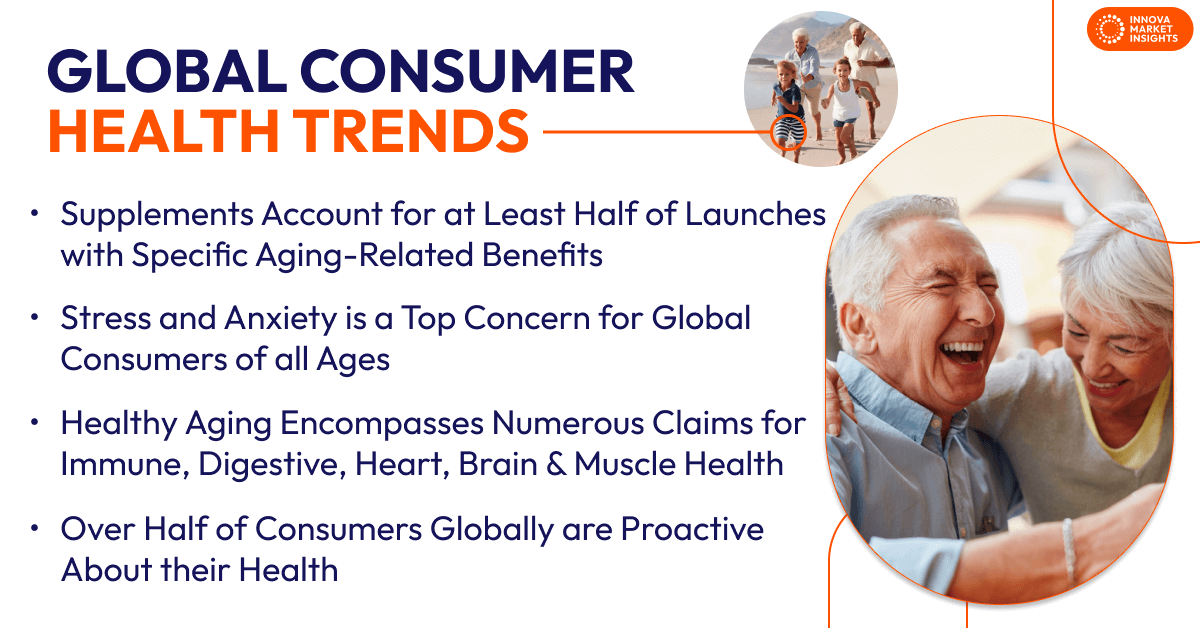

Globally, over half of consumers are taking a proactive approach to health, with Brazil leading the consumer health trends. Ages 25 to 44 are prime years for prioritizing health, as many in this group follow targeted nutrition plans to prevent health conditions.

Regular food and beverages are the preferred way to achieve targeted nutrition, especially in Canada and Spain, where 55% of consumers prioritize this approach. Health trends show that supplements are most widely used in Brazil, Indonesia, and Canada, while younger consumers favor nutrition-fortified food and beverages.

Global consumer health trends reveal that weight management, heart health, and healthy aging are top concerns, though priorities vary with age. Younger consumers focus on weight management, skin, and immune health, while those aged 25-44 express the highest level of concern across several conditions. The demand for balanced nutrition products is strong, and interest in age-specific solutions rises with age. Consumers in this 25-44 age group are also the most likely to purchase targeted nutrition products.

Stress and anxiety are a top concern for consumers of all ages. Health trends show that Boomers are more concerned than others about memory, mental agility, and clear thinking. Meanwhile, consumers in Indonesia and Latin America are more concerned than others about stress. To address these concerns, consumers turn to fiber for gut health and vitamins and minerals for mental well-being.

Healthy Aging Product Launch Trends

There has been a 9% rise in food and beverage launches with healthy aging claims over the past five years. Health trends indicate that healthy aging food and beverage and clinical nutrition launches are most prominent in Asia and Western Europe. Africa and the Middle East show the fastest growth in food and beverage with healthy aging claims, whereas Australasia and the Middle East are growing in clinical nutrition product launches with healthy aging claims.

Consumer health trends reveal that healthy aging supplement launches are most prominent in North America and Western Europe. Africa shows the strongest growth from a smaller base. Across food and beverage, leading claims focus on immune, digestive, and gut health. Supplements emphasize immunity, brain and mood, and skin health. Clinical nutrition products target wellness, immunity, and diabetes management, reflecting current health trends.

Consumer Immune Health Trends

Supplements are the leading category for launches with an immune health claim, accounting for over two-thirds of launches over the past year. Supplements, soft drinks, and dairy account for over 85% of immunity claims.

Health trends show that Immune health remains a key focus in both supplements and food and beverage categories, with products evolving to meet consumer demand. In supplements, vitamins and minerals, particularly zinc, lead immune health claims, alongside botanical and herbal formulations, probiotics for boosting immunity through better gut health, and hair, skin, and nail products.

The supplement growth leaders feature products for hair, skin and nails, weight loss, and men’s specialty. Mushrooms and collagen are gaining attention in healthy aging supplements with launches with an immune health claim.

In food and beverages, juices and nectars are the top subcategory due to their vitamin C content, while tea incorporates herbal ingredients, and drinking yogurt and fermented beverages offer probiotics for immunity. Consumer health trends reveal that growth is most notable in energy drinks, kombucha, and dairy alternatives, with botanicals, minerals, and vitamins driving immune health formulations.

Digestive and Gut Health Trends

Health trends indicate that gut health remains a major focus in both supplements and food and beverage categories, with growing consumer interest in digestive support. Supplements drive the gut health market, while dairy leads food and beverage products with digestive health claims, followed by soft drinks, hot drinks, cereals, and bakery. Reflecting current health trends, tea, iced tea, and yogurt are top food and beverage subcategories with a digestive or gut health claim, with herbal teas offering digestive comfort and yogurt providing probiotics.

Key functional ingredients in food and beverages include soluble fiber, tea, and herbal extracts. Green tea and licorice ingredients are growing in launches for their digestive and overall health benefits. In supplements, collagen, aloe vera, dandelion, bromelain, chlorella, and spirulina show modest growth, with collagen appearing in multiple forms. Brands can watch for multiple health trends associated with mushrooms.

Heart and Bone Health Trends

Two-thirds of heart health launches in the past year are supplements, while food and beverage products with heart health claims spread among various categories. Global consumer health trends show that the fastest growing are fish and seafood, margarine and other blends, and rice in food and beverage launches. Traditional heart health ingredients like omega-3s become less prominent, while functional ingredients evolve, with reishi mushroom displaying the strongest growth in supplements.

Bone health innovation is also supplement-driven, though dairy is the leading category in food and beverages. Unflavored milk, dairy alternatives, flavored milk, and malt and other hot beverages are prominent subcategories. Naturally occurring calcium is the top functional component of food and beverage products with a bone health claim. While food and beverage products rarely include added ingredients, supplements widely incorporate different collagen forms, including fish, marine, and beef.

Weight and Muscle Health Trends

Health trends reveal that food and beverages play a long-standing role in weight management, accounting for half of related claims. Soft drinks, particularly meal replacements, lead the category, while drink concentrates, sweet biscuits, cookies, and meal components drive growth. Weight management ingredients in food and beverage include essential minerals. Green tea and its natural caffeine are positioned for weight loss, alongside essential minerals, nutrients, and fiber-rich supplements that support energy.

Muscle health innovation spans supplements and food and beverages, including dairy, ready meals, and meat/fish/eggs. High-protein formulations dominate muscle health claims, with supplements featuring concentrates and gender-specific solutions. Collagen ingredients help drive muscle health benefits in supplements.

Sleep, Energy, and Brain Health Trends

Supplements lead in launches for sleep, energy, and brain health benefits. Sleep-focused supplements account for 85% of launches, featuring botanical and herbal, melatonin, and essential vitamins and minerals. Hot tea is the major subcategory in food and beverage launches with sleep benefits, reflecting the current consumer health trends. The ayurvedic botanical ashwagandha is increasingly prevalent in sleep supplements. Brands are focusing on botanical ingredients for sleep focus.

Three-quarters of launches with energy claims are supplements in the past year. Energy-boosting products also rely heavily on supplements, with vitamins, minerals, and botanicals playing key roles. Soft drinks, dairy, and hot drinks lead in energy claims, with caffeine as the most common functional ingredient.

Brain health supplements account for nearly 9 in 10 product launches. Ashwagandha, L-theanine, and omega-3 fatty acids are most commonly associated with mood and brain health in supplements. Functional beverages, including soft drinks, dairy, and hot drinks, often feature caffeine, flaxseed, and green tea to support cognitive function and mood.

What is Next in Global Consumer Health Trends?

Collagen stands out as a key ingredient in healthy aging, supporting mobility, bone, joint, and muscle health while benefiting from its strong association with protein. Global consumer health trends indicate that consumers increasingly seek functional ingredients and balanced nutrition, making collagen a good choice.

Despite this demand, food and beverage launches remain under positioned for healthy aging, even as consumers prefer a balanced dietary approach over supplementation. Economic concerns further drive interest in cost-effective nutrition solutions. Concentrated supplement formats are gaining attention, offering multiple benefits in a single product, reducing the need for multiple pills, and enhancing convenience, reflecting the consumer health trends. Brands that integrate functional ingredients like collagen into accessible, multi-benefit formats are likely to align with consumer needs for both nutrition, healthy aging, and affordability.

This article is based on Innova’s Now & Next with Healthy Aging – Global report. This report is available to purchase or with an Innova Reports subscription. Reach out to find out more